Sf Clipper Card Do I Need to Scan Again When Transfer

'Your Claim Is Closed': Victims Of EDD Debit Card Scam Fighting Bank Of America To Get Money Back

SAN FRANCISCO (KPIX 5) - Fighting to get unemployment compensation has been hard enough for so many since the pandemic. So, imagine how it feels once you finally have money coming in, to see it all stolen away.

KPIX was the first to expose what appears to be a massive fraud problem involving the use of unemployment debit cards issued by Bank of America. Since then, we have received more than 60 emails from people who say their EDD debit card was hacked and they lost thousands of dollars.

"I sort of shouted out, oh my god, almost all of my unemployment has been hacked!"

Brooke Suchomel described her reaction a few weeks ago when she went online to check her Bank of America EDD card balance. Two charges, one for $1500 at Neiman Marcus and another for $1200 at the online luxury vendor Intermix had wiped out her account.

"It had been drained overnight, the day before rent was due," said Suchomel.

She says she was on hold for hours, two days straight before she was finally able to file a claim. She's still fighting to get all her money back.

"Bank of America isn't taking this seriously," said Suchomel. "It absolutely feels like we are being treated like second-class citizens."

ALSO READ: Outrage Mounts After Bank Of America Denies Claims From Victims Of EDD Bank Card Scammers

Suchomel reached out to KPIX after seeing our previous reports about others caught in the very same predicament. Since then, we've received even more emails, everyone desperately crying out for help. So, we invited them to a group interview.

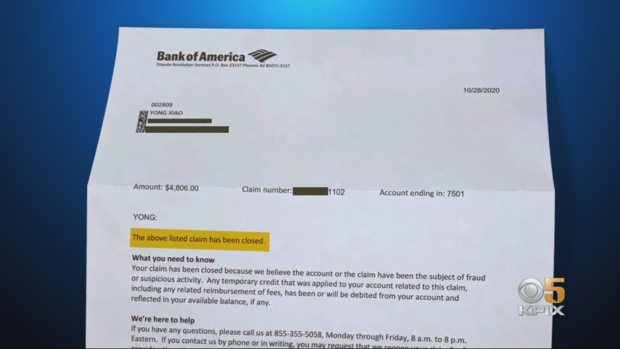

First we asked how much money they have lost. Luis Harbottle told us he lost $1000. Tina Lee lost $2000, in two transactions of $1000 each. Paula Xiao told us her mother lost $4806 and Paul Camera told us he lost $5,998.

Everyone in the group lost their jobs because of the pandemic and depends on their unemployment benefits to survive.

"I'm a widow I have three kids. Rent is coming up soon, I work in the food industry, so I got hit hard," said Lieza Sy.

"It's unfair because I'm a single mother. I have a son," said Erica Young.

But they say trying to get Bank of America to help is almost impossible.

"On the phone on hold two to three hours, click, call again," said Maria Ramirez.

"Can I put you on hold? Click!" said Kris Quinn.

"I actually went into the bank myself twice to try to get help in person and they were like oh don't talk to us! Call the number on the wall," said Tina Lee.

And they say once you do get through, Louis Harbottle says, "Basically what they do is try to make you feel guilty saying no this is a valid withdrawal."

The victims believe all of the transactions had obvious red flags.

"We can see it happened at two ATMs, miles away from me in the middle of the night," said Kris Quinn.

"How did I make two transactions in San Diego and Arizona within minutes of each other?" asked Heath Medeiros.

Despite providing evidence, victims say Bank of America did nothing for them.

"I sent them my police report and the FTC report, receipts I used the same day they were withdrawing in a different city," said Maria Ramirez.

"And they have cameras on those ATM machines," said Lieza Sy.

Instead, days after filing claims, they say they got letters that say, "The above listed claim has been closed."

"The letter was dated the 20th, I didn't make the initial claim until the 19th, so nothing was investigated. The letter was generated as soon as I hung up the phone," said Erica Young.

Bank of America's letter goes on to say "you may request that we re-open your claim."

But victims say that too seems to go nowhere.

"I actually called this morning at 7 a.m. They gave me a new claim number. But what use is that if we can't even check the status of that claim?" said Paula Xiao.

"I know I am not exempt from fraud, I know it's just the time we are living in people are going to get more desperate. But when you have an institution as large as Bank of America and they're refusing to do anything about it and the state is aware of it too, I just don't think that's fair," said Erica Young.

Bank of America once again turned down our request for an interview. The bank won't tell us how many customers are affected, how much has been stolen or when if ever victims will get their money back.

"They can't just deny claims that they know are probably fraudulent," said Lauren Saunders with the National Consumer Law Center.

Saunders says the real problem is forcing people to use the debit card that, as we have reported, does not have a security chip.

She says the California Employment Development Department may be doing a run around federal law by offering only paper checks as an alternate, but not allowing direct deposit, something most other states offer.

"What California does is really force people into these cards, where under the law, you have the right to choose how you receive your unemployment benefits," said Saunders.

The Employment Development Department's exclusive contract with Bank of America may have something to do with it. It's a revenue-sharing agreement, in which EDD gives the bank the taxpayer funds to distribute and the bank in return pays EDD for the privilege of handling the money. So it's profitable for both Bank of America and EDD.

"I think that's part of the reason California is pushing people into using the cards rather than using direct deposit," said Saunders.

"I don't even understand why Bank of America has this long-standing contract with EDD. It doesn't make sense to me. It's a horrible situation," said Tina Lee.

"I just wanted to say that to all of you don't give up, there is protection under that Visa logo that Bank of America puts on that prepaid card. I will get my money back. I'm not going to stop. I'm not gonna let it go," said Erica Young.

EDD told us if the fraud is happening on the card, then it is up to Bank of America to resolve it and pay victims back. But when we asked Bank of America about that, the answer came back, "No comment."

KPIX has been giving the names of victims that have contacted us to Bank of America. So far, 13 got their money back. If your EDD debit card has been hacked send us an email and we will submit your name as well.

Statement from Bank of America (William Halldin):

Unfortunately, there has been billions of dollars of fraud during this pandemic in state unemployment programs, including California. We are working with the state and law enforcement to identify and take action against fraudulent applicants, protect taxpayer money and ensure that legitimate applicants can access their benefits.

We have increased our call center staffing for our pre-paid cards nearly 20-fold since the pandemic began and continue to add staff to serve people calling in. We encourage anyone with a claim to contact us and provide supporting documents, if possible, so we can review their situation as quickly as possible.

Statement from EDD (Loree Levy):

Funds from potentially fraudulent accounts currently remain with B of A. Under the terms of the contract, funds on inactivated cards stay with B of A for more than a year before the card is closed and funds are returned to EDD in May of the subsequent year.

There are some limited direct deposit options available under the existing contract, and the contract did contemplate EDD transitioning to direct deposit during the term of the contract. If you have a debit card, though, you can arrange for your benefits to be deposited directly into your bank account automatically. For instance, claimants can set up their account up so that, once EDD transfers funds to their card, rather than load the card, Bank of America deposits it into the claimants bank account. However, this service is not available without having a card.

Here's a link to the B of A FAQ's which answers how people can initiate this option: https://prepaid.bankofamerica.com/EddCard/Program/FAQ#q8

The contract is set to expire in July 2021 and the EDD will be reviewing all options available when we solicit new proposals.

Source: https://www.cbsnews.com/sanfrancisco/news/your-claim-is-closed-victims-of-edd-debit-card-scam-fighting-bank-of-america-to-get-their-money-back/

0 Response to "Sf Clipper Card Do I Need to Scan Again When Transfer"

Post a Comment